From Extraction to Contribution: Regeneration

R. Guarnaccia Pham 2023

Regeneration is the positive feedback from adaptive adjustments which ensure the continuity of a system (and the systems in which it is embedded) which defines true growth. (Reichheld 2006) Living systems thrive not by seeking to do less harm, they are integrated in such a way that moves the entire ecosystem forward. Regeneration is the process of renewal. Our bodies do it in each moment of living; they are bustling construction sites of cells turning over regenerating all the time because that is what life does to ensure continuity (Picerno et al 2021). Perpetual works in progress. Masters of adaptation.

Everything living has this capacity, and everything we consistently fuel with our intellectual, inventive, human capital, can be designed in this same way. We are through the era of discovering physical laws and we are seeing into new horizons: the realm of understanding living systems, the patterns and principles they practice, in order to design (re-design) with those principles in our toolbox to become the keystone species we are capable of becoming. Not just to support our own and all other life, but to move ourselves flourishing forward as a species dependent on the health and wellness of our planet and its biodiversity. It might be difficult for some to imagine, when our imaginations are fueled by our experience, and there might be some trillionaires who propose we launch ourselves into space (with food and oxygen from this planet in tow) but reading further will show what investments are gaining the best traction.

Adaptation

Businesses and Investment Funds know “change is the only constant” – those who survive recognize that innovation (adaptation) is the only long-term survival plan within the shifting dynamics of the markets, resources, knowledge, behavior. They know (or find out) that our economic systems are not mechanistic; where a series of steps leads to predictable outputs - an approach relevant for creating complicated products, but not for complex systems like our markets; composed of interconnected elements, with non-linear interactions that require integrated, contextual approaches. Successful traders can speak to this reality. It is the ability to learn and adjust that defines the long-term success of a business or fund or a person, just as organisms evolve within their ecosystems.

Embeddedness

What is new, on the edge of our understanding, is realizing how embedded systems affect other systems, and acknowledging that outcomes are changeable - evolving. The predominant mental model might still like to pretend we have a crystal ball or expertise enough to make accurate predictions, but when we do so in linear ways in our siloed areas of knowledge and tools, it fails to encapsulate the entire picture - unintended outcomes ensue, externalities arise, and we must time and again come to terms with the reality that our crystal ball is a smokey mirror in which we can barely see ourselves and the true results of our actions.

We are beginning to internalize the understanding that ‘complex’ does not equal complicated. The difficulty lies in applying mechanistic, reductionist, approaches to complex systems, an approach we use simply because it was revolutionary in our history. A hammer that helped us nail down discoveries and processes, but we’ve moved past the industrial revolution.

Collectively, we can intellectually accept that humans are not equivalent to cogs within the machine of business and exchange, and that individuals are not always equipped with the information necessary to make choices with the best outcomes (a premise on which our economic systems are based – which has indeed levered those with the most information: often passed down by family, friends, and networks). Most importantly, we can be invigorated by knowing we are at a leverage point: our ‘advancement’ thus far arose from our drilling down into siloed expertise, and the next step towards actual advancement is seeing everything in context. Integrated, relational, responsive, and growing.

Growth – More of What?

What are we growing right now? When we grow the bottom line, or have extra income where does it go? If we could buy “xyz” – what would we want? Really. Does it feed back to what we want to see more of in our lives? Our incentive models can be designed to create more of what we want to experience in our lives. It takes a quick look at luxury items to see what people pay for: beauty, good treatment by others, new experiences, peace, health, and as always – time in nature. (One might argue that people signal status with luxury items, but as recent shifts show, those moving up the economic ladder participate in signaling, but it is the ability to afford the former that is inseparable from economic status. Those living rich lives focusing on what they value will attest that satisfaction is separate from signals. We each choose our own way.) People are addicted to money because it’s their means of survival, freedom, mobility, but moving up the Maslow’s hierarchy of needs, when there is ‘extra’, we pay for experiences, culture, time, luxury (being cared for). More on our measures of value later.

Terms: TradFi – traditional finance led by governments and large companies for investing, borrowing, lending. DeFi – recreates traditional financial instruments in a decentralized architecture outside of company and governmental control. ReFi – regenerative financial systems aligned with the universal patterns and principles of living systems to build stable, healthy, and sustainable outcomes. Triple bottom line (TBL) – coined by John Elkington, refers to business focus on three bottom lines: profit, people, planet. With focus not only on financial profits, but social and environmental outcomes. Firms that focus solely on financial profits, while ignoring people and planet, do not adequately account for the cost and positive impact of doing business.

Speaking at the Capital Institute, Katherine Collins asks where are people feeling scarcity? What is being expressed? In finance it shows up as “not enough, so we have to create more” – More of what? Getting to the bottom of these questions will clarify what we want more of so we can design accordingly. Perhaps people are feeling scarcity with the things they feel create value, “but it’s much easier to talk about the dollars, so that’s what we talk about.” (Collins 2023)

Original Error

The original error in economics can be traced back to the scientific revolution: in the search to legitimize the study of economics, influencers presumed there were natural laws of economics analogous to Newtons physical laws (which later developed into Neoclassical economics). Since economics is not a hard science (lack of testable hypotheses and inability to achieve consensus), Behavioral Economics entered the scene along with lingo in finance and insurance associated with challenges in risk management in a non-ergodic financial landscape: Fat Tails, Black Swan Events, Tail Risk, Volatility Clustering, Markov Chain Monte Carlo, Regime Shifts, Bayesian Inference. No wonder we hand our money over to someone else to handle.

These terms collectively reflect the awareness within the finance and insurance industries that traditional models based on ergodic assumptions fall short in addressing the complexities of (non-ergodic) reality. As a result, specialized language and methodologies are used to enhance risk management strategies in dynamic and unpredictable environments. However, the design of human-made systems still exists within the reductionist paradigm. We still apply rigid metrics to try and make ‘data driven decisions’ while complexity accurately describes most of reality: ecosystems, economics, civilization, medicine, organizations, etcetera. It begs the question: what data is included? What can we include to be closer to a full picture of reality? Remembering that what gets measured, gets managed.

While the original error created some minor defects at first, it has not simply resulted in complicated lingo - we’ve reached the point where our systems are guzzling more money and energy to sustain the status quo then is necessary if we allow ourselves to go through the release mode of the Complex Adaptative System loop (explored below). Applying the incorrect approach has resulted in a plethora of unintended consequences that are presenting as today’s crises.

The current paradigm uses the term ‘externality’ – a cost or benefit incurred by a third party (not reflected in the final cost or benefit of a good or service). Labelling an outcome as an externality is a farce when everything is connected to everything else: embedded systems affect other systems – a business externalizing its waste into the environment impacts human and non-human health. It helps some to value non-human health, to understand it all eventually cycles back to the human because this is where we exist.

At The Capital Institute John Fullerton highlights, “If our human economy is to evolve and thrive over the long run, its system design must align with the patterns and principles (of living systems).” The economy needs to be embedded within civilization, civilization needs to be embedded in the planet - and within planetary boundaries. We can design in this way.

My humble addition to this, for those who may equate boundaries with limitations; regeneration is the only way to ‘expand our boundaries’ growing beyond what we currently think is possible. Growing less of a mess and growing more of what we want to see in the world.

What Gets Measured Gets Managed: Decoupling ‘Growth’ from Resource Consumption

We are learning that interrogating waste identifies interesting ways to boost profitability:

Shaw Industries, the world's largest carpet manufacturer, makes its product with healthy and safe materials retaining their value for infinite cycles. It guarantees the recovery of its Cradle-to-Cradle Certified carpet tiles, saving $4 million annually on water and energy costs. (Dizdarevic 2022)

The Green Book: From Degenerative to Regenerative Design invites the return to basics, to consider what innovative designs we can apply to our current and future business model elements to reach regeneration.

Christensen, Bartman, & van Bever (2016) explore business model innovation and corporate renewal to help companies learn how to create robust corporate-level business creation engines to renew their organizations and power growth.

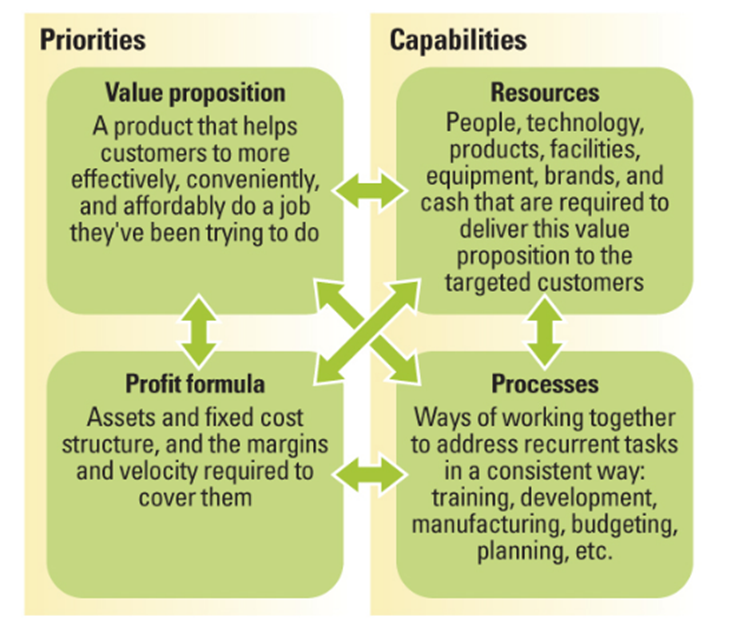

The Basic Elements of a Business Model: (1) a value proposition for customers; (2) resources, such as people, money, and technology; (3) the processes that the organization uses to convert inputs to finished products or services; and (4) the profit formula that dictates the margins, asset velocity, and scale required to achieve an attractive return. Interdependencies within these elements means that integration is required for components of the model to be congruent.

Incentives

Imagine changing the incentives or processes at a big business that may already be providing the economic habitat of income – to invest in the place from which its resources come and invest in its people. Imagine being able to check in and see the difference made in the environment, community, and culture.

Tying metrics to value can be tricky. Or it feels tricky right now due to fragmentation. We may not be consciously choosing the order our values are in; however, we can notice our values through action and in our decision making. What is prioritized as a primary value can have a prism effect, creating a lens through which you see everything else. For example, if you view happiness in terms of mediatized social cues, or wellbeing.

This is important because individuals surviving and acting within a system tend to make choices based on what the system values. But as intelligent actors or agents within a system, we influence this dynamic by being intentional about the decisions we make, the values we prioritize, and noticing what obstacles can be removed. Sometimes it is not about doing more but doing less, especially if we are obstructing the power of our actions through bureaucratic means.

Katherine Trebeck speaking at the Capital Institute sets forth examples of what we spend collectively and as individuals dealing with the collateral damage of an economic system not designed to deliver the outcomes we need. Cornerstone Indicators are metrics that speak to various dimensions of wellbeing and pass the hurdle of making sense to everyday people: such as the number of girls riding their bikes to school alone. This represents intersectional data that emerges as wellbeing. The type of qualitative analysis our ‘gut’ instincts react to when looking for a place to live which reflects a confluence of intrinsic economic health measures. “Then we can start making those statistics matter by bringing those to policy decisions, cost benefit analysis, helping departments work together to develop long-term planning.” (Trebeck 2023)

Trebeck says our “challenges are more mundane” than we realize. Heroic decision making can be done by the purchasing, accounting, and administrative departments, by changing the criteria and checklists they use – “the people in (these departments) have all kids of ideas.” In Australia they illustrate the edge-effect principle by are supporting cross-departmental exchange: If housing changes something and the benefits show up in the police department, each are rewarded, encouraging ways they can invest in these exchanges. Additionally, 6 Capitals: How Accountants Can Save the Planet, argues the P&L and Balance Sheet formats created for the Industrial Age a century ago fail to report the financial health of companies in the Information Age, and discusses upgrading the prevailing double book entry system (accounting for financial and industrial capital) to a six capitals accounting system.

As individuals and companies, we can practice making decisions based on a different value. We can test out decisions based on a value, see the result, the result creates a sense of trust and slowly that value climbs the ladder (in our brain, heart, experience). Our power lies in “having all our intelligences at play” (Storm 2023) which shifts the system around you. Regeneration is the positive feedback from adaptive adjustments.

Traders, Complexity, Risk

The term “ergodic” was just thrown out there, let’s address it then talk about the CAS loop. But first a talk from Top Traders Unplugged, where Richard Brennan and Niels Kaastrup-Larsen discuss risk within complex systems and the health of their investment fund:

Richard Brennan: “When we look at things serially in time evolving, we can see how these systems can start with very simple fundamental nonlinear rules and evolve into these fantastic complex structures called universe, living systems, our bodies, the financial markets. In physics they're starting to use agent-based models with the simplest core rules. As the system evolves over an iterative process, step after step, complex structures are being built within that architecture as it evolves through time, and all of it is correlated. That whole system, every relationship in that system is correlated. When we look at things in cause-and-effect terms, we notice that the spatial envelope the possibility of things to exist within that system are all constrained within those very simple rules we used at the outset: that defines the space of possible states in the future that the whole system can occupy.

[Noise refers to random disturbances or fluctuations that affect the behavior of a dynamic system.] People that say that there is noise or randomness are not looking closely enough; we find in these complex models that when we add noise back to systems we get more information out of that system, which (seems) bizarre, but there is nothing random about it, this is the majesty of a system in action.

Look close enough in an evolving landscape of iterative succession; when we look at a rainforest, or our bodies - how does the body develop with this amazing structure with hearts lungs brains skin skeleton etcetera from these simple rules - starting off as an egg with a bit of DNA that gives morphology, but it's not the morphology that says what is going to occur - it's how the body evolves and how the epigenetics and the chemistry interact with the rules defined by the DNA that gives this glorious structure.

The only way I can define risk for a human body is to know the holistic state of all aspects of that system: the health of the heart, the health of the lungs, the health of its blood, its skeleton - this isn't Sharps Ratio in action, this is Wisdom in action.

We see the majesty of how these things unfold in this system – whereas the reductionist approach sees rigid detail, missing all the connections to look at it holistically – (business) looks at the track record of experience: as a health statement. We can look at the track record of a fund manager with our history, managers that have existed for 40 years not knowing what the next step is - it's not like an effect test environment where we're assessing risk for evaporation - these people have lived risk, it’s their experience and track record. When people ask me what sort of risk metric you can use to compare programs, I say go and talk to them, get to know what's under the hood - do your due diligence, understand all aspects. Live and breathe what they understand, that's how you deal with risk - you can't use a metric to assess risk for goodness’ sake, you have to look at the important things in dealing with risk.”

Neils: “A validated track record like our own of almost 50 years shows a couple of things: We embrace a robust methodology, and we have people who are very good at what they do. We have kept that DNA as a firm. It's not the same people in the 70’s that are running the firms now in 2023, the constituents of the firm have changed over the course of time, which tells that the system and the process is robust because it allows for a change of its constituents - those people who have come later have been incredibly good at evolving the system because no such system stays the same. I cannot say ‘because we've done well for 48 years we will always do well’ - but what we can say is we have a mindset, an ideology… a set of golden rules to implement the way we feel is the best, and we have in fact been able to navigate incredibly different market environments. That’s what gives me stability in an unknown and uncertain future - I believe we will continue to be able to do that.”

Richard Brennan: “As an investor, that's exactly the statement I'd be looking for… the conviction you just expressed in your survivability and endurance and adaptability. The statements you made would be my risk assessment of you and your firm, these things can't be quantified into a rigid bit of data, this stuff is much more comprehensive than that.” (Brennan 2023)

Ergodicity: Knowledge Pooling in Action - Accelerating Knowledge, Capacity, and Navigation

There is an emphasis on our ability to be rational creatures, especially within economic and financial models. We certainly have a cultivated ability to rationalize, typically after the fact, but that is not the same thing as having all the information at hand in order to make a ‘rational’ decision.

Ergodicity is a concept originating from statistical mechanics and thermodynamics. It refers to the property of a system that (with enough time) explores all possible states with an equal probability. If a system is ergodic, one can gain statistical information about the whole system by observing a single part of it over a long period. In an ergodic system, the experiences of an average person over time are considered representative of the experiences of all individuals at any given point in time. This assumption is central to certain economic models, but it clearly does not reflect the dynamics of real-world scenarios (Peters 2019).

It’s akin to assuming a chess player’s moves in a single game will represent the average strategy employed by all players: Imagine a player repeatedly playing chess games, exploring different positions. Over time, their moves will lead them to various states on the chessboard. Ergodicity implies with enough games and moves; the player will eventually visit all parts of the state space in a uniform and random sense. In an ergodic system, the average behavior of the player (or the system) can be deduced from the trajectory of a “typical” game. Perhaps it’s a time scale issue, but the probabilities of success from a collection of people do not apply to one person, in a single moment of time, making a decision with whatever information happens to be available, while considering the real-life dynamics and pressures of that person in that moment, along a linear timeline where is there no re-wind “make a different decision and see how that plays out” button.

“A way to identify an ergodic situation is to ask do I get the same result if I: 1. Look at one individual’s trajectory across time 2. Look at a bunch of individual’s trajectories at a single point in time. If yes: ergodic. If not: non-ergodic. We tend to think (and are taught to think) as though most systems are ergodic. However, pretty much every human system is non-ergodic. By treating things that are non-ergodic as if they are ergodic creates a risk of ruin. This is particularly true in the case of financial education. Most finance material assumes ergodicity (that time and ensemble probabilities are the same) even though it is never the case. If you lose all your money, you are in no way comforted that other people who you don’t know did fine. Even if their assessment of the probabilities were right, no person can get the returns of the market unless they have infinite pockets. If the investor has to eventually reduce his or her exposure because of losses, or margin calls, or because of retirement, or because a loved one got sick and needed expensive treatment, the investor’s returns will be divorced from those of the market. This is why examples such as “If you had bought Amazon stock in 1999 and held it for 20 years, you would have done great” are dumb. From 1999, the price of that stock collapsed by over 90%. The type of person that bought a bunch of Amazon stock in 1999 probably also bought a bunch of other stocks and had a job in tech. In 2001, they (likely) had to sell everything to make rent”. (Pearson 2023)

Let’s pause – Our economic and financial theories presuppose we can and will make the decisions based on statistical averages and patterns and assume that we have access to all the relevant information needed to make rational decisions in the marketplace. Now let’s have a moment of silence for these assumptions.

Assuming ergodicity oversimplifies the dynamic nature of decision-making under uncertainty, and whatever information a person has at one time. Ergodicity does not account for the fact that a person makes decisions based on the context of their situation. (Plus, people get their financial education at home or from friends, or the current internet where everyone is selling something in order to sustain themselves in this economy).

There is a way to become more ergodic as individuals: through diversification, tail risk hedging, dynamic asset allocation, assessing resilience by simulating scenarios and potential outcomes, modeling that adapts to changing market dynamics, monitoring risks rather than relying on historical data, staying informed and adjusting approaches, having long term goals and avoidance of impulsive decisions based on short-term market fluctuations – all of which are applicable to real life, we just do not use this terminology on the daily.

Also, by pooling knowledge through the following: decision processes that involve multiple stakeholders, tapping into the collective intelligence of a diverse group to gather information and generate ideas with enriched perspectives and enhanced problem-solving. Encourage transparent communication to share knowledge and insights, create spaces dedicated to exchanging valuable information and expertise. Engage in interdisciplinary projects, joint ventures, or partnerships that bring together professionals from different fields to tackle complex issues. Cultivate a culture of continuous learning and curiosity, hold Scenario Planning on potential future developments. Implement mentorship programs, knowledge-sharing sessions, or internal platforms for employees to exchange expertise. Network outside your immediate circle to access a broader range of insights. Pooling knowledge through these strategies, individuals and organizations can enhance their collective intelligence, adaptability, and resilience in the face of uncertainty, contributing to a more ergodic approach to decision-making and problem-solving.

The wealth of networks and collective intelligence is a subject onto itself, with ancient roots – and new sprouts including Open-Source Software, Energy Network Science (ENS – see also Flow Networks (Goerner 2015)), the MIT Center for Collective Intelligence, COINS, and others. For example, The SINE Foundation solves data sharing dilemmas organizations face which keeps their data siloed over fears of losing control. They fuse technology with governance mechanisms, enabling organizations to share their data securely, and to maintain their data sovereignty along the way - even after it has been shared. Companies need to tackle issues from across the value chain but face three main challenges: Inconsistency in existing methods and standards, missing interoperability of technology solutions, and the risk of exposing sensitive data. The data are locked and siloed in isolated islands within complex value chains. SINE is currently building an open and global network of interoperable solutions for the secure peer-to-peer exchange of emission data.

Amazing things are happening, though most grasp change like a toddler takes to broccoli, especially when it’s a collection of humans permissibly acting out their routine and approved behavior within a larger organization. There are many systems that resist change to remain as they are – the issue is these systems arose from a primary error (resulting in a paradigm) which is why many of our solutions are ineffective or create further complication. By aligning with what we know of how life works and cycles - the patterns, principles, and embeddedness of systems - we can see where we are, know the macro scale of where we are going, and design effectively – and in ways that allow us to grow rather than live in reactive, predictive, or panic mode: each mode entirely dependent on the information we have available to us.

Clarity and Alignment: Life’s Loop – Where We Are and Where We are Going.

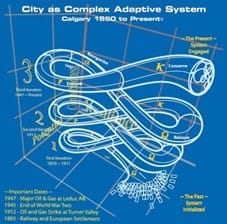

Let’s dip our toes into the Complex Adaptive System (CAS) by first revisiting embedded systems: you as an organism are a complex adaptive ‘system’, embedded within human civilization, which is entirely dependent upon our biosphere, which is nested within our solar system, nested within the universe. Now let’s reverse the ‘direction’ to see where the human-made systems meant to serve us fit in: the economy nested within our human civilization, with finance embedded within that economic system. Our current brief is to shift, adjust, design our human-made systems (that act in accordance with our design – they are not hard sciences, they obey our implementation and agency) to be in service to us. To be in service to all life.

To uncomplicate these terms: The Economy is the sum of all activities, and Finance is the function of how we manipulate (handle) money. How did it get to be so complicated that those terms can trigger disinterest or diversion? It’s tempting to think it was by design, if we do not have clarity, it allows others to operate without scrutiny. Perhaps it’s the unintended complication due to primary errors - then lingo is created, people select into cliques of doing, then it’s off to the races. Today, both are at play. Just as we had the ability to correct our assumptions about physical sciences, seeing “with new eyes” through scientific observation that the Earth revolves around the sun - which challenged the paradigm of its day – We now know enough about the processes of life to comprehend where we are in the process, and design accordingly.

Examples of complex adaptive systems range from ant colonies to financial markets to the human immune system, to democracies and all types of ecosystems. Agents within CAS are actors with the capacity to adjust in response to a change in the environment; like players in a sports game adapt to changes in their environment through a regulatory system, or a bird in an ecosystem, or a trader in the market - receives information and responds to the local information available. Zooming in to context of a human body, nerve cells act as agents transmitting signals and contributing to overall function. Zooming out to the macro human systems, the human individual agent contributes to the system’s overall behavior, adapting to local cues and influencing the system’s emergent properties.

What is life? It’s not a noun, it’s a verb – it’s not a thing, it’s a process. (Russell 2017)

The Complex Adaptive System

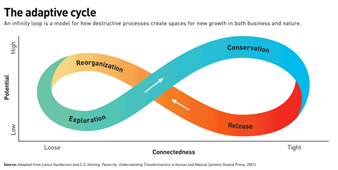

Conservation, Release, Reorganization, and Exploration form a continuous cycle on micro and macro scales. Each phase contributes to the system's resilience and adaptability:

Conservation brings stability but unnaturally extending this stage makes the system vulnerable.

Release allows adaptation and emergence of resilience.

Reorganization is a creative phase, setting the stage for the system's evolution.

Exploration is growth, complexity, and positive feedback leading towards Conservation.

This cycle of conservation, release, reorganization, and exploration happens on micro to macro scales: in these images imagine smaller loops of various ‘sizes’ embedded within the larger loops. Practice picturing different systems around you; some are in exploration phase, while others are in conservation. For example, a company in exploration phase can exist within a larger economic system in conservation phase. But because humans can intervene and unnaturally extend the life cycles of one of these stages, perhaps out of fear or greed, it is necessary to understand the cycle to see the potential and possibility of what is to come to create resilient systems in alignment with living processes.

Pause and please consider that we each know how to move through these loops on personal levels and bring attention to how the words ‘micro’ and ‘macro’ land: Perhaps the inclination to place the micro label on what happens on the personal level or small scale – however, living through it does not feel small, it feels macro to you. Whereas the macro or large scale let’s say pertaining to institutions, perhaps feels micro to an individual. What feels bigger to you - moving jobs, or your local schools teaching ecology? A relationship breakup, or changing bank accounts to an institution that does not invest in fossil fuels? What we think of as huge shifts in our institutions is put in perspective, knowing they are supposed to serve us and rely on our participation.

Imagine our reliance on networks empowering us to effortlessly nurture ideas, self-organize, establish connections, and collaborate seamlessly. In such a landscape, what could blossom from our inquisitiveness and solutions? Picture a realm where the collective intellectual capital of numerous minds collaboratively enhances their local surroundings, steering away from antiquated top-down control that often leads to systems falling short of delivering optimal service. It is already beginning, delivering success and there are so many ways to plug into the action.

In the conservation phase, we encounter stability, equilibrium, and controlled development. However, there's a predisposition towards rigidity, with few key nodes holding concentrated influence and low diversity in nodes and pathways. This rigidity renders the system brittle and susceptible to disruption due to reduced diversity and a lack of self-organization. When we become accustomed to and dependent on prevailing conditions, our ability to adapt diminishes.

Sometimes, we artificially extend the life cycle of this stage, investing energy or money to maintain the status quo. Consider it akin to a house hastily constructed (during economic downturns or rapid urbanization when resources and skilled labor are limited) that now requires repeated expensive repairs, when an overhaul might be more effective. This is not to propose that we destroy the status quo and start fresh. No, instead imagine the house is a complex adaptive system with elements able to adjust themselves and create new and better connections to enhance performance – this is the capacity of the human within the ecosystem or economic system. While personally one may dream about a living learning home while enjoying the freedom that entails, for now, just think of the human capacity within the ecosystem or economic system capable of adjusting and creating new connections for enhanced performance.

Contemplate instances where money or energy is injected into conserving a system inevitably disrupted by innovation, entrepreneurship, and technology. For example, the Detroit Big 3: We did not allow reorganization, we pumped money into conserving the system (energy expended because people depended on the design) which could have directed towards R&D - Now in 2023, we see car companies are disrupted anyway by innovation. (Compare to the exploration phase of car company inceptions). How can we view these disruptions as clues to allow the CAS cycle to continue and move with the flow rather than impede it and build up pressures towards dramatic large-scale shifts?

Invitation to evaluate cycles on national and personal scales, such as shifting generational economic conditions: The post-world war era saw a period of economic prosperity, stability, and growth, leading to the prevalence of long-term employment with a single company. The rise of globalization increased merger and acquisition activities as well as corporate restructuring, downsizing, and outsourcing, making job security less certain. People managed by seeking new opportunities, the evolution of technology and the digital age brought new industries and enabled remote work. Shifts from an industrial to a knowledge-based economy increased the demand for specialized skills. The rise of the gig economy and online platforms eased access to short-term projects and freelance work. Lack of investment in the business itself and its employees shifted the mindset toward viewing careers as a series of projects rather than a linear progression within one organization. Even in linear careers such as medicine, 21st century grads make a quarter of what their seniors made, face greater liability, typically saddled with enormous school debt, to enter the specialization where CS level suites are not run by those familiar with medicine, but by HomeDepot executives placed by private equity groups and the trickledown effect is seen in our health “care” system. Individuals are more likely to change jobs throughout their careers for various reasons, including some sense of appreciation at work, skill development, and changing economic conditions.

We can recognize when conservation cycles reach a state of stagnation and ponder how interventions, like government subsidies or interventions in business and banking, impact potential innovations and course corrections that might arise if the market was to truly “decide” what thrives or withers. Currently the impetus is on individuals to navigate in these larger cycles (in the paragraph above a plethora of personal stories you are privy to may have come to mind, while interventions band-aid the status quo in favor of institutions that are not designed or expected to innovate – while socializing costs and internalizing profits.

Release: The collapse of conservation marks the release phase, where positive feedback triggers dramatic change, allowing the system to adapt and evolve. Small-scale releases, analogous to a forest surviving a tree falling, contribute to system resilience through autonomous adaptations. Like the bark of a tree adjusting to pests or oxygen levels at a smaller scale for the tree to remain stable.

In human systems, bureaucracy impedes these smaller scale releases, leaving the system vulnerable to large scale release: releases on the smaller scale are less dramatic than when they accumulate on a larger scale. Pick something in your sphere of observation and contemplate what is stopping small scale releases.

Diversity maintained through small-scale disturbances enhances system resilience and the system cultivates resources from which it can pull during a crisis. Emergent leadership arises during this release phase when actors (regardless of tasked role) informally assume key roles - you, dear reader, are an emergent leader. More on that in a moment.

Reorganization and Exploration *the fast back loop*:

Reorganization involves system recovery, with emerging species better attuned to existing conditions. (Investing note - pick companies that make it through a market downturn, because they are not going to receive free flowing cash from venture, they have to be turning real business). It's a creative time with multiple potential directions, growth contingent on choices made during release. Reorientation of the system reconnects pathways and nodes, providing opportunities for new elements to enter and become more prominent (species, nutrients, individuals, groups, institutions).

Exploration ushers in a new environment, growth, increasing complexity, the prototyping of different ideas, creating freely available resources for more development, feedback loops, self-organizing, and untapped potential. Positive feedback on emergent patterns scales up towards conservation.

Note that conservation is beneficial, except when artificially sustained - leading to brittleness and vulnerability when contextual demands shift towards the next phase for enhanced resilience. Remember, crafting systems that permit small-scale release and exploration contributes to the resilience of the larger system.

Consider applying this cycle to an area of interest and explore how it relates or intertwines with another area in a different phase of the cycle. Within the loops of complex adaptive systems, we can more clearly see “where we are” and where we are going. Your perspective evaluates the context.

“In this world that is a complex system, things are changing all the time, and changing non-linearly all the time, where do you stand and how do you stand? With all these factors at play, you don’t know which one has more influence than the other, what do you do? We have been taught to look for steadiness, consistency, but LIFE is in this infinite loop all the time. Realizing this brings us into wholeness: to realize you yourself are a complex system – and to be whole, realizing we are the very kind of system we are working with. Embodying the very idea complex systems tells us about, which is that nature is fractal, everything you see in the small also exists in the big. These “high theories” are present in every instant, everywhere, all the time - and it’s all inside. It’s so natural. All we have to do is be still and there it is. To function well in this system, you must be integrated within yourself.” -Tanuja Prasad, Regenerative Investing Institute

At Regenerative Investing Institute, they believe in business (in general) but do not believe in business as usual. Their aim is to provide investment products that take (any) business on a path towards regeneration. Tanuja says, “Complexity science is a different pair of glasses, to see things differently. Once you see things differently, you cannot unsee them.” Her recommended homework is to “take a printed article about startups, finance, economics, whatever, and switch the language to a regenerative language - not as a contradiction, but as a reframing. The article must be written such that it draws the reader toward their own wholeness. Instead of contradictions or the intent to convince, if we are to see through this different frame, what would that look like?” Tanuja’s theory: As we draw closer to wholeness, write through wholeness, it draws people in, we feel better, they feel better - more of themselves and everything else – and it regenerates just like that.

We can shift small amounts, and it will have profound impacts on the system. The extractive model acknowledges the power of human attention. How do we design where to attract attention? Create the motivation to act in what ways? Do we ask what people want to see more of in the world (and in themselves) and design to elicit those behaviors? Design now is not engaged in people bringing their whole selves. Changing the design, changes the experience, and changes the work. Creating the conditions for health within the system, or organization is the goal – because creating the conditions for health creates good outcomes.

Seeing Ourselves as Part of a Living System

Regenerative Economics: 8 Principles

Living systems are constantly sensing and responding, when injured, they can heal themselves with self-organized responses, they have a process of adapting to new conditions by creating new capacities internally. Nature, as many of us already know, is the most successful designer. The degree of thriving depends on the quality of relationship to produce vibrant life; relationships that collaborate like organs in our own bodies (especially when provided proper nutrition from food grown in rich soil and animals eating from rich biodiversity). This life process is the regenerative process.

We see patterns repeat across scales and contexts: To align our human economy with the patterns and principles of how life works, John Fullerton at Capital Institute describes these principles as tendencies – not “laws” (as a law pertains to physics, and it is by misapplying physical laws to economics that we are in the misconceived framework and current mess in which we find ourselves (Fullerton 2023)). Instead, “We can draw from the only framework that has stood the test of time, the living system.” (Benyus 2023).

In Right Relationship: Humanity is an integral part of an interconnected web of life in which there is no real separation between "us" and "it". The scale of the economy matters in relation to the biosphere in which it is embedded: Addressing fractures in finance is crucial for restoring vital relationships between key stakeholders. Applicable at both micro and macro scales, this principal advocates for an economic harmony with the biosphere, recognizing that damage to any part of the interconnected web affects the entirety. It echoes the principles of reciprocity and mutualism, fundamental to a regenerative economy rooted in biological, Indigenous, ethical, and religious wisdom.

Views Wealth Holistically: True wealth transcends monetary holdings; it must be managed systemically on the well-being of the entire ecosystem. This involves the harmonization of capitals; encompassing social/relational, cultural, spiritual (however one defines it), intellectual, and experiential capitals. All these forms of wealth rest on the foundation of natural capital and in particular healthy ecosystem function, upon which all life — inclusive of our human economies — depend.

Innovative, Adaptive, Responsive: In a world where change is both ever-present and accelerating, the qualities of innovation and adaptability are critical to health. The entrepreneurial dynamism associated with a free enterprise system and the free flow of capital is essential. Both must be channeled in a way that is responsive to the changing dynamics and essential needs of systemic health rather than short term outlooks.

Empowered Participation: In an interconnected system, fitness is derived from contributing to overall health. Empowered participation necessitates that all components maintain a symbiotic relationship with the larger whole, empowering them to advocate for their needs while contributing uniquely to the collective well-being. Beyond moral considerations, there exists a scientifically grounded systemic obligation to address inequality for the overall health of the system.

Honors Community and Place: Human communities are intricate amalgamations shaped by myriad factors such as geography, history, culture, and changing human needs. A Regenerative Economy seeks to nurture resilient communities and bioregions, each one uniquely informed by the essence of its individual history and place. This poses a substantial challenge to the centralized structure of modern global corporations. Forward-thinking leaders are already transitioning towards a more decentralized management structure aligned with specific locales.

Edge Effect Abundance: Creativity and abundance flourish at the 'edges' of systems, at the transitions between systems. Imagine coastal areas or a mountainous region transitioning into a valley – the meeting point between the rugged mountain terrain and the gentler valley ecosystem results in a distinct environment hosting a diverse array of plant and animal species adapted to both mountainous and valley conditions. In the business domain, collaborations between industries, such as technology and healthcare, with amalgamation of expertise from distinct domains leads to innovative solutions and the sprouting of novel ideas. Collaborative efforts across these edges, fostering continual learning and development, prove transformative for communities and individuals involved. Although business leaders grasp the shift away from considering the firm's boundary the sole relevant 'whole' under management, it’s currently elusive for financial analysts.

Robust Circulatory Flow: Like the human body needs good circulation, economic health thrives on robust flows of money, information, resources, services, and goods. Efficient use and reuse of materials is key. This principle opens the door to new metrics and better public policy.

Seeks Dynamic Balance: Dynamic balance is essential to systemic health. Regenerative systems engage in a perpetual dance, harmonizing multiple variables as opposed to optimizing single ones. [RG1]

“A Regenerative Economy strives for efficiency and resilience, collaboration and competition, diversity and coherence, and the varied organizational scales of small, medium, and large enterprises. It draws upon universal principles of health discernible across diverse systems in the cosmos. Departing from conventional sustainability approaches, and traditional reductionist logic employed to 'solve problems,’ it directs its focus towards building robust human networks, leveraging universal principles and patterns, making 'sustainability' a natural byproduct of systemic health. (Think holistic healthcare in contrast to reductionist disease care).” -John Fullerton (2023)

Unintended Consequences/ Fragmentation

Mechanical approaches can provide predictable outcomes when applied to complicated things. But when applied to complex systems, the security evaporates and unintended consequences unfold, creating new issues, new areas of study, new frameworks to apply to see if they at least band-aid the situation. Reductionist approaches applied to complex systems - such as a human body, or a collection of humans, or an ecosystem - fragments elements to make them easier to study, which is one step towards plugging it back into context: Can you understand a hand without knowing its context to the body? Can you understand the ecosystem services a plant provides by taking it completely out of context? If you want to see a picture, you do not focus on a few pixels. Reductionist approaches ultimately create more confusion because they are not seeing the interconnected context. The result: we live in a highly fragmented world – you do not need someone pointing out where fragmentation exists, we can see it everywhere, and within ourselves as well.

As Laura Storm noted in her presentation at Capital institute, we are nature – “better at problem solving and creating – we can stop treating ourselves as robots that can sit in front of a screen.” (Does this point to the root of angst over AI?) The potential is for us now to remember and reimagine what it is to be human so we can connect to nature, including our own nature.

Innovation Opportunities

The word innovation is a touchstone here, but in today’s paradigm it’s a buzzword. We call something innovative just because it’s new, not because it’s a significant level up in functioning revolutionarily better. McKinsey writes about the best practices of ‘innovative growers’ siting the pursuit of multiple pathways “both in the core business and adjacent markets where there are opportunities to create value and invest in R&D, because organizations that invest in innovation during periods of uncertainty are more likely to stay ahead by finding emerging pockets of growth.” (Jong et al 2015) A sentence stands out as directed to their audience, “Since no one knows exactly where valuable innovations will emerge, and searching everywhere is impractical, executives must create some boundary conditions for the opportunity spaces they want to explore.” Provides the sense that leadership will have comfort and control about the direction of their business when successful examples prove the efficacy of leadership is in listening into the system to determine strategic moves. At healthcare organization, Buurtzorg Nederland allowing ‘the system’ to sense and respond reduced their costs by 40% and improved profitability by 60%. Tapping into ideas from healthcare employees in the field, the feedback was used to develop the strategy in an ongoing way constantly adapting to changes in the field. Ideas from self-organizing teams resulted in spin-off growth into 15 different market sectors. Now there are over 15,000 employees and 850 teams in town and villages all over Holland and 24 other countries.

We can “search everywhere” with pooled knowledge: the enhanced perspective of sensors in the field and individual contribution towards the system. Companies can ask: do we need to hire the same kind of people (because it feels easier), or do we need to disrupt this practice? Do we hire to tap into potential? Do we value cross functional teams and idea generation processes? Are we trained to collaborate with what each of us brings to the table? Moving from representation to individual expertise, making entry points for novice engagement, and creating pathways by listening to what is around you.

City planners and Mayors can practice Urban Acupuncture (Cutieru 2020). Three-time mayor Jaime Lerner of Curitiba Brazil speaks to constantly sensing into potential risk and unleashing opportunities cultivating one of the poorest cities into one of the richest. Ironically, the progressive urban planning of Curitiba itself was not initiated by a democratic process; it was set in motion by the military dictatorship that seized power in 1964 and ruled Brazil until the mid-’80s. Its environmentalism is rooted in authoritarianism (Lubow 2007). Makes one wonder what can be accomplished with the principle of Empowered Participation. Makes one wonder if we can agree enough to get to action.

Agreement

It might feel “impossible” to approach a picture of the future collaboratively. In his talk at Capital Institute, Allan Savory (The Savory Institute) said “when you start envisioning the economy with institutions it ends in conflict” and shared his approach to working with the people on what they want for the land. This story starts with conflict:

The US fish and wildlife service at Lee Creek, OK asked local community to gather, but when Allan got to the meeting there were only men. He asked why no families were represented, discovering the men expected this meeting to break out into a fight. Allan sat with them and began to talk about a holistic context around the national refuge –the area being managed and where the conflicts arose. After ridiculing him, telling him he knew nothing, to go back home, that it’s “impossible” to agree and tensions were about to break, Allan paused and agreed to stop the meeting. Then asked for just one more thing “Will you agree to just one hour and prove me wrong, don't just tell me I'm wrong, prove me wrong.” They agreed to stay and prove him wrong. (“How would you face that group of men when you need to talk about love and caring and their families?” Allan asks, “they would have ridiculed me more.”) Thinking fast, he gave out pieces of paper saying, "Please each of you, take just 10 minutes, be totally selfish, think only of yourself, to hell with anyone else, I want you to describe on this piece of paper in your own words what you would like to see in this community if you could come back in 20, 50, 100 years."

He got the bits of paper back, the result: absolute unity, “you couldn't tall who was a bureaucrat, who was a farmer, who was a businessman. The whole atmosphere changed. Within the hour we had a holistic context.” Then he said, “look out the window, you're not going to have this vision unless we do something,” so they created it. (Savory 2023)

A lot of money is spent on ‘growth’ initiatives. Harvard Business Review reported $100 billion spent at 1,350 companies in a two-year window with results that failed to materialize, due to unspoken disagreements, and inability to scale pilot projects, citing that “leaders sidestepped this challenge entirely by building internal Innovation Factories inside the larger organization to develop and grow pilot projects” (Sutcliff et al 2019). Small experimental labs innovate faster and cheaper, not limited to R&D or product design - they work end to end, starting with the incubation of new ideas, moving through the design of potential solutions, and on to deployment and scaling. Importantly, they are highly integrated into the organization; the factory team is part of the same lab, works on the same factory floor, and includes people from all functions, not just R&D.

Incubators can be set up to listen into the organization, the community, find ways of internalizing ‘externalities’ – allowing for spinoff enterprises to emerge and filter into different markets, leading to more profit. External opportunities to bridge gaps companies are not internally addressing can be created for example through Excess Materials Exchange (https://excessmaterialsexchange.com/en_us/).

Without large pools of money, Grassroots Economics [RGP2] has developed a unique model blending social commitment, digital tools, creating an innovative approach to supply demand dynamics involving Community Asset Vouchers (CAVs) - a bearer instrument representing a community's commitment to providing specific products or services (also usable as a local medium of exchange and for traditional rotational labor accounting). The buy-in starts like a CSA (Community Supported Agriculture) providing the safety net of guaranteed demand for farmers, which circulates back into more CAVs upon fulfillment and validation of products, while embedding impact metrics within the financial transactions. (Ruddick 2023)

Weaving Incentives and Outcomes

We can use the eight principles to assess whether changes are addressing root causes or merely responding to symptoms. Ultimately, we have to do both. We must create the path as we walk it, which means there is an in between space where it’s possible to capitalize on cleaning up the current mess, as we create businesses and infrastructures that serve these principles long term. At the same time, we can shift current incentives to break through the limitations inherently imposed on our choices.

“Only 17% of institutional investors reported they link compensation to a timeframe of two years or longer. The majority link compensation to timeframes under a year, making performance within a truncated timeframe the status quo. Compensation incentives drive short term decision making, and the larger incentive – the fear of being fired – ensures managers’ obsession with short term results and staying with the pack.

Ecological issues including climate and water, manifest at first very slowly, then suddenly. They remain beyond the decision-making incentive systems of most investment managers. Market prices for products such as commodities reflect immediate supply and demand realities. For example, fracking increased supply so that oil and natural gas are a fraction of their recent peak – this lower price sends the wrong price signal to consumers.” (Fullerton 2023)

Everyone wants a return on their investment. If you are not in business to make a profit, to maintain the business and its participants and investors, you are not in business very long. The regenerative economy will not depend on philanthropy or volunteers. As we walk the path toward a truly regenerative economy, philanthropy is appreciated but itself is an indicator that our current system produces high concentrations of wealth in areas where gatekeeps control the flow of resources.

Profits support and sustain the people working in enterprises, to expand our positive impact on people, planet, profit beyond the limitations inherent in the current flow of transactions. Profit, regardless of currency, is simply a means of exchange for resources to ensure the agents within the enterprise, which are systems in themselves, can sustain and thrive. This is the very goal of an organization: to meet the needs of all agents and its own needs, to continue to be in service to other agents and systems. Profit in ecosystems can be seen as an organism’s mechanisms to optimize the use of available resources to meet their needs for growth, survival, and reproduction. Both in nature and economics, effective resource management is a key factor in achieving success and longevity. The following sections touch the surface of each topic to be expanded on DecaDust.com.

Effective management

Mapping the ecosystem of a company, or city, or an individual life, we can understand how elements of our organizations connect into wholeness and move away from rigid Performance Indicators (which can cause disruptive feedback loops and toxic power dynamics), into dynamic metrics and Cornerstone Indicators. We start asking who is a part of our greater ecosystem and how can we create a win-win-win? As Interface did by hiring local fishermen (Jacques 2014).

Our coordination issues can be solved through tools enhancing visibility of what is happening in this space to show microcosms of what change looks like in communities and organizations. One is underway that will eventually become a tool to know where you can plug in and get paid, because we need economics around these enterprises.

Adaptations: Making Adjustments

In an interview with Tim Ferris, master negotiator William Ury speaks to the 1978 Egyptian - Israeli negotiations at Camp David resolving in a peace treaty that has lasted more than 45 years. “No one likes to make a hard decision, but everyone likes to criticize,” states Ury. It began with the US asking for criticism (not agreement or concessions); after revisions responding to the critiques on both sides, they came to a resolution which both parties could agree on. The episode talks about applying our creativity to the way we negotiate, calling it ‘the software of humans’ to be inventive, the power of looking behind what is presented into the underlying interests – identifying the wants, fears, desires – behind a request (or unrelenting position), and writing the other sides victory speech: “What are they going to use to explain to others why they agreed to X. These leaders need to go back to their cabinets, their populace, and explain why they did X.” Considering the external judgement helps discover nuances in the ask (Ury 2024).

If you are sitting in a leverage point or know someone who is, you’ll have ideas of what a win-win situation might look like, or you’ll have access to those you can ask. Who can you bring together to share critiques and generate ideas? Create openings, pathways, remove obstacles. Create conversations on what Cornerstone Indicators reflect the dimensions of wellbeing in the context being addressed.

Think about this: Everything you have known and experienced up to this point is data gathering on what you want to see more of in the world, and what you want to see less of. What you value, and what you know is not of value. This is something best known from an internal point within. Beneath or beyond rationalizations and justifications. Humans do have instinct: you can think of your ‘gut’ or intuition as the deepest part of you, the part that can do internal calculations at the highest place. Identify it, separate it from your fears, your hopes, the voices in your head – to cultivate, reawaken instinct and listen.

Your perspective, shaped by experiences, teachings, and your own understanding, is important data – plus you are an embodiment of original intelligence (whatever way you may feel and define this). And this is where we begin: right where you are. With your external knowledge and internal wisdom, your insights, and connections. You are sitting in some leverage point, ready to trim tab (Fuller) from this place. Start from where you are and expand into projects, communities, companies – creating ecosystemic ripples. Seeing a person as a data collector of observations, experiences, insights, is captivating in today’s obsession with data, where data creates investible value, one wonders what meaning that data holds.

Perhaps carry a question or two with you and begin asking – not to place the burden on others, but to share in the imagining – activating our imaginal cells, and our data gathering thus far. To share not just what is not working, but digging underneath that into what we want - creating new pathways, removing the obstacles that stand in the way.

Each individual finds themselves in the system they were born into or now operate within – all of us feel the pressure of short-term incentives, (starting with the bottom of the pyramid in Maslow’s hierarchy). Let’s accept that bad systems make good people do bad things (Deming 1993). Accept where we are, and (instead of finding where to place blame or forcing opinions upon one another) practice treating each other as individuals, connecting to things we share. This creates political will. To make what is intellectually correct possible.

We think of things as ‘impossible’ until someone does it. First operating from the paradigm in alignment with how living systems function; some of us can make the right actions institutionally acceptable and institutionally investible. At the same time, others do not have to wait for institutions to push forward in their activities because actions on all fronts motivates all things forward faster.

Price: Arbitrary? Or perspective of Value?

Reflections that correct pricing creates functioning capitalism makes one take a closer look at price. The conventional way is to price arbitrarily and let the ‘market’ figure it out. But there are ways to include value on the balance sheet. (Do we measure prices with their health cost? Do we divorce our ‘sick care’ from contributing to positive GDP?) Ultimately the failure to comprehend the role of currency as a means of value exchange goes all the way to addressing the role of finance to address the root cause of issues we care deeply about - And getting clear about the questions. [Note that our currency is not derivative of anything anymore].

Traditionally, when economists put a dollar value on an ecosystem service, they use one of three ways: what are people willing to pay for that service (Ex: Water: shall we calculate the $ spent on water filtration systems?), ask what you would require in financial compensation to give up that service (Ex: Health: might we use the associated health care costs connected to the plethora of toxic ‘environmental’ exposures to building materials in our homes, chemical leaching into our food and water, air - we can also ask what is not measured in association to its cause that is in fact traceable), and finally, what is the cost of an engineering solution to provide the equivalent service (Ex: Food: what is an engineering solution for pollinating our food? An ecosystem service readily supplied by Bees).

We can measure the functions in an ecosystem and design our infrastructure around these functions: switching to permeable pavement, green roofs, phytoremediation walls, integrating territory for pollination gardens (imagine the value add of the NY Highline designed in this way). Pathways to regeneration and designing life for flow, in ways perhaps now beyond our imagination – creating and utilizing technology that serves life.

Leaders in this area will create something inviting, showing pathways to what we want, so others can live and experience it - rather than going back time again to what is familiar, what we have adjusted to over time with all the associated costs. How can we help people have an experience they haven’t had before? One that shifts and opens to an experience of life beyond their prior imagination. Outline the concreteness of what we would like to see transpire. How can we give people a vision, resonance, so they can craft from their reserves (and restore their reserves)? How can we guide or support in this way? What actions and speech enforce or deforce resonance, that inner knowing we all have because it’s a connection to what we are all doing here: living and experiencing. How do you get people to see it in their own way (without any preaching)? When we test, and see the result, it creates trust, that generates more testing, more experience.

A class host at nRhythm says we tend to look for what to do, but we can practice looking at what not to do. “What if regenerative principles are innate? And what we really need to begin to do is remove the barriers in the way so those principles can be expressed every day? Curating the conditions or the dynamics for emergence. For Example: instead of cultivating compassion, how do we remove the barriers for tenderness to come through? How do we listen in?”

At the Center for Ecozoic Studies, Alexandar Lazlo reminds us that the curator of a museum does not make the art, but they place the art in order to create the experience for visitors to walk in wonder. What can you curate?

Creating the conditions for health in every sector of life: soil, food, microbiome, building materials, organization operations, finance, etcetera, ripples forward and reflects in our mental wellness, relationships, life satisfaction and includes the biodiversity and regenerating richness of all other life.

Metrics – Creating the Conditions for Health

What is measured reflects what is considered important. It comes back to values and can be viewed as a measuring and monitoring challenge, but one that is not insurmountable given the plethora of metrics we already use to evaluate performance. Metrics can show our Biodiversity Net Gain – landowners in Ireland/UK demonstrated their rewilding, their permaculture, and were paid (Department of Housing 2023).

Change Decision Making

The functional roles of who we consider industry experts, investment committees, ecological representation to put Nature on the Board, all need to map to expertise and knowledge of place and using appropriate technology to address challenges. For example, $30 billion was invested in a western conceived solution to the sewage issue (Ruben, Kapur-Gomes 2020), where installation of composting tiger worm toilets proved to be the actual solution to the sewage overrun from monsoons in India.

Look at the structure of decision making at the organization: is there an inverse or direct relationship between decision makers and the experts providing the data? Sometimes structures have a foundation of analysis and expertise but through a professional game of telephone, implementation is diluted.

Look at what is included in the data and democratize it: Unity Catalog democratizes data by levering one consistent model to discover, access, and share data with better management (data providers still maintain management) and security across clouds, with audit trails to see who has performed what action, using a common interface for collaboration on any workspace, which removes data team silos.

Potential in Action

For a dose of dopamine about the incredible human potential to act as contributors in regenerative design: Visit Our Cities at C40.org which offers a framework for city governments to be applied in both new and existing neighborhoods globally (https://www.c40reinventingcities.org/ and https://www.c40knowledgehub.org/). It includes the Collective for Climate Project in Paris’ La Porte de Montreuil neighborhood which aims to reduce 85% of operational and embodied emissions and require all buildings to be adaptable or reversible, and in Milan, L’Innesto will be the first Zero Carbon “Housing Sociale” district in Italy, featuring a neighbourhood heating system powered by renewable sources (including urban wastewater heat-recovery). In Helsinki, the Kalasatama district is a model area for smart urban development and a climate pioneer: Rather than purchase goods and services, the city procured innovative pilot projects, allowing new businesses to develop new ideas with citizens, putting co-creation at the core of this smart ecological district. Corredores Verdes, an interconnected network of greenspace in Medellín, has reduced the impact from urban heat, planted over 8,800 trees and facilitated 75 citizens from disadvantaged backgrounds to access training to become city gardeners.

Meanwhilespace.com lists previous and current projects, one in collaboration with London’s Haringey Council uses the previously vacant Blue House Yard site to foster vibrant local life. Designboom.com explores cutting edge developments around the globe, many of which get the juices flowing for what is possible in repurposing materials. Meanwhile, an abandoned indoor waterpark on the banks of the river Maas in Rotterdam is a trial mini circular economy locally called the Blue City. Thirty businesses all share resources and reuse: Beneath the pool, craft brewers develop a pioneering chemical-free rainwater purification system, their ‘waste’ from brewing is repurposed by another business, while another makes mango leather and recycles plastic into new 3D-printed products. (The mango leather is from old mangos, and it is beyond the scope of this paper to ask: why are so many mangos going uneaten? If nature is producing this much, what other life would be eating it? Yet these are left in because it is this type of questioning that can dig toward the roots of finding solutions in alignment with truly regenerative practices. Going beyond repurposing ‘waste’ to not having any because it is part of a life supporting loop).

Barcelona’s Superblocks programme is a Republic of Hyper neighbors in Paris, France. Residents say the deliberate shift to good neighborliness has changed their lives. This includes not only Frenchmen, but immigrants to the area as well, who feel they’re living in the Paris they always imagined, reporting “It’s absolutely wonderful here, the ambience is unique,” and, “Conviviality is an economic actor.” Carlos Moreno, the Paris-based professor behind the concept of the 15-minute city, “allows it to be regenerated on three levels: ecological, economic and social.” Collaborating with the nonprofit Les Alchimistes, the group installed several compost areas: used by 800 Super Neighbors, they process 60 tons of organic waste a year, an abnormally high 98 percent of which has been correctly deposited. The success of the project led City Hall to spend 31,000 euros to install eight more. With support from the city’s Participatory Budget, which allows citizens to vote on municipal spending, the Republic of Super Neighbors has already revitalized a forgotten public square into a vibrant events space, and it is applying for funding to buy communal e-bike chargers and an electric cargo bike for residents to transport goods locally. In the future, the group hopes to open a medical center geared toward local needs. They are exploring borrowing and lending groups, creating blueprints for its vision of cities to be replicated and scaled up: carved in the image of and powered by the bonds between inhabitants. It believes the answer is the creation of trained and paid roles — so-called Friends of the Neighborhood — to coordinate each district. This type of social lab can be replicated by identifying the acupuncture points, encouraging the type of activity that made a HUB. A living blueprint of what binds people together. “People are listening… Everyone wants their neighborhood to be like ours. Now we need to find out how to make our approach more systemic and to adapt it to the different challenges and contexts that every city in the world has.” – Bernard (Yeung 2022).

Verticals: Find Your Niche

What is happening ‘out there’ is also happening ‘at home’ – and these rooted sprouts of activity gaining traction provide proof of what is possible - what is possible there, is also possible at home. A good time to mention Natural Capital Vertical. A vertical market is a market encompassing a group of companies and customers that are all interconnected around a specific niche. Companies in a vertical market are attuned to that market’s specialized needs. Vertical market businesses have the benefit of targeting a narrower customer base. A company that specializes in a vertical can provide targeted insight and specialized services to clients, becoming an integral component of their business over the long term. What can be more niche than cultivating space for new markets to emerge, knowing that with all of our natural diversity, each human has universal feelings and needs (and similar problems we all face)?

The activity in the agriculture space is rightly gaining traction, as (great news) converting regular farms to regenerative practices can draw down carbon and will start to roll climate change backward (Lovins 2023). Encouragingly, sixty years of conventional farming can be recovered in two years.

“Regenerative agriculture enables farmers and ranchers to sequester enormous amounts of carbon in the soil — and at a profit. If farmers around the world adopt the practice, it will start to roll climate change backward. Regenerative agriculture enhances native biodiversity, cuts costs, water use is optimized, farm worker safety is improved, creates jobs, and melds the best of modern science with ancient culture. For insight on different approaches, see A Finer Future, Creating an Economy in Service to Life.)

General Mills and Nestle are on board with switching to regenerative agriculture. One may argue it’s not because of the goodness of their hearts, they are of course doing so because it’s good for business, however (with correct implementation) it’s a win on all fronts and indicates the power of working from within a company. There are resources such as the Center for Regenerative Agriculture, Ecosystem Services Market Consortium (ESMC), Kiss the Ground, Rodale Institute, and Agroecology majors are offered at multiple universities. There is more to be done and you can make influential connections by bringing better methods to attention. To replace fertilizer, vermicomposting utilizes the ecosystem services of worms and microorganisms to transform food waste into soil (even the biophilic may need some help appreciating the iridescent, musclebound, soil creators - at home, we call these wonderful creatures Dirt Dolphins, imagining the richness life in the soil relative to that within the glistening sea, where the strange is intriguingly beautiful). There are also liquid bio amendments, or compost tea, Nigel Palmer shows how to make your own locally sourced mineral and biological amendments to close waste gaps at https://www.nigel-palmer.com. Paul Stamets’ Mycelium Running — How Mushrooms Can Help Save the World (2005) is an invaluable resource for regenerative culture designers. From high quality tasty protein sources, broad spectrum medicinal use and water filtration, to applications in agriculture, forestry, soil remediation and ecosystems restoration.

It’s a challenge in the order of multiples of billions of dollars and an opportunity to regenerate the species - and for agriculture it all starts with the small microbes, the mycelium relationships. Quick mention that the soil microbiome is intrinsically linked to our gut biome which translates also to our mental wellbeing (Deans 2016; Queensland Health 2022; Asbjornsdottir et al 2022).

Several speakers at Capital Institute spoke to the huge amounts of money wanting to be poured into restoring damaged ecosystems and communities. How can we shift global systems to be in service to people doing work that affects us all? Colin LeDuc calls the shift a supply chain issue, saying they are a “40-billion-dollar fund in the soup of an economy in the trillions.” He reiterates that “everyday your money is voting for something.” This can mean spending, but also refers to where we bank: how that bank invests our aggregated dollars, and also how we actively decide where to put investments. Some of us can get to the table with big players and some will stack functions: integrating elements so they provide more than each could do on their own, for beneficial transactions that provide more diversity, abundance, and resilience.